Best Certificate of Insurance Tracking Software

Protect Your Business From Costly Claims

Ask your CFO or Risk Manager just how much claims and lawsuits can cost your business. If you are collecting certificates just to confirm they were received, you have no guarantee that your requirements are being met. myCOI Central is built on a foundation of insurance industry logic to ensure you remain protected with the appropriate coverage.

Automate Your COI Tracking

There’s no more need to worry about stacks of certificates cluttering up your office or hours of frustrating phone calls and emails to chase down certificates. myCOI Central provides your company with a solution to automate your insurance certificate requests, collection, and compliance resolution, while also giving your team a single, centralized repository to view compliance.

For Agents & Brokers

Win business and boost retention by providing agency branded, industry leading insurance tracking software to your insureds. Offer software only or add on your own compliance review services.

What Are The Benefits of COI Software?

View all CasesWorkers Compensation Certificates

Most of us know what a workers comp certificate is, but let’s cover the basics again just in case. Valid workers’ compensation certification is proof that a business carries workers’ comp coverage. Workers compensation certificates are issued by the insurer at the request of an organization that seeks to confirm that the business is covered. In the same way that you, as the business owner, need to ensure that your business and your employees are covered, so does any business that hires you.

Many businesses are legally required to carry worker’s compensation coverage for their employees. Each state in the United States regulates worker’s compensation coverage under its own laws, which means the potential penalties, fines, and even periods of imprisonment vary.

There are exceptions to the need for workers’ compensation certification, but they are unique to each state. Know the laws in your state. Protect yourself and your employees.

For example, in Indiana, the Indiana Department of Revenue issues a Worker’s Compensation Exemption Certificate Clearance to individual taxpayers who are independent contractors or otherwise not required to carry worker’s compensation insurance on themselves under the Worker’s Compensation Act of Indiana. Persons and/or businesses that qualify for such exemption are issued forms that act as a workers comp exemption letter.

Whether you’re self-employed, a small business owner, or even on the other side as a compliance admin for a large company, workers comp is a complicated, but necessary, process to work through.

Workers Comp Certificate Example

Let’s pretend you’re a new compliance admin who’s just received a worker’s compensation certificate of insurance (COI). Do you know what you’re looking for? Do you know which boxes on the form are the important ones? It’s okay if you don’t: let’s talk about some of the high points. There’s a lot riding on making sure this COI covers both what the contractor says it does, and that the coverage is what your own company expects of those you do business with.

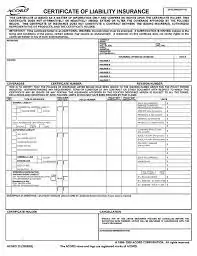

One of the most common workers comp certificate of insurance samples is the common ACORD-25 liability form.

The ACORD 25 is a basic workers comp certificate example. It records and identifies the contractual agreements between the insurer and the insured. Put another way, it helps you know which policies, protections, exemptions and provisions your potential new contractor is carrying.

This form is pretty self-explanatory: the fields and boxes are pretty well labeled, but let’s go through the high points. At the top you’ll have boxes for producer and insured; make sure your contractor is listed in the insured box!

The coverages boxes are where the details are recorded, with fields like general liability, automobile liability, garage liability, excess or umbrella coverage, and finally what we’re here to talk about: workers compensation and employers’ liability. Check the information in these boxes carefully against your company’s requirements. If they don’t line up, then you’ll need to have the contractors adjust their coverage.

Or find a new contractor.

There are a limited number of cases where a subcontractor may present you with a workers comp exemption certificate instead. We’ll talk about those farther down.

Fake Workers Comp Certificate

If you’re a shady contractor looking for tips on how to fake workers comp certificates, keep searching. We’re not talking about that. We’re going to talk about how to catch you. Almost every business that hires contractors has been presented with a fake workers comp certificate at least once. Sometimes these fake certificates are detected; sometimes they’re not. Sometimes it’s too late. Here’s what you can do to spot them before then.

States maintain websites to verify workers compensation. Check those sites. Sometimes they’re hard to find, but it’s an easy Web search. Just put in, for example if you’re in Massachusetts, “proof of coverage ma”. The state verification site will come up. If the contractor you’re evaluating doesn’t show up on that list, that’s a red flag.

You can also look for obvious flaws: does it look copy-and-pasted? Are there obviously six different fonts in use? Is the paper, believe it or not, different colors in different spots? Those sound like childish things to look for, but people trying to circumvent their legal requirements don’t always put the most time into it. They’re counting on you not paying close attention.

Pay close attention.

Seeking proof of workers’ compensation insurance from your contractors and other businesses you do business with is not a hassle for those companies, no matter what they may say. It’s the cost of doing business in today’s litigious world. There is risk apparent in every company, in every industry, and it’s everyone’s job to responsibly manage it.

Workers’ Compensation Certificates Of Insurance For Subcontractors

Workers compensation and subcontractors sometimes gets complicated. Many states make statements like this one from Indiana: individual taxpayers who are independent contractors or otherwise not required to carry worker’s compensation insurance on themselves under the Worker’s Compensation Act of Indiana. But there’s a lot of room around the edges of a statement like that.

Even with that, almost every governing body or advisory body will suggest that you request workers’ compensation certificates of insurance for subcontractors who do business with you. It’s just good practice. Despite not being required, many subcontractors and independent contractors will carry the requisite insurance, and connect you with their agent to request the certificate of workers’ compensation insurance.

You may even get a ghost policy, and no: that’s not a joke. Self-employed individuals with no other employees often carry a policy that excludes them, which gives them workers’ comp with no employees.

That may not seem like it makes any sense, and at first glance it doesn’t, but let’s look at it in more detail.

Ghost Policy Workers’ Comp Definition

The so-called ghost policy workers comp definition is pretty simple. A single-person business, such as a subcontractor who works regularly with a general contractor, buys an affordable workers compensation policy. But here’s where the ghost part comes in: the policy excludes the business owner, so it doesn’t cover anyone. The running joke is that it protects a ghost that follows the subcontractor around.

Why do these subcontractors do this? The simple answer is that general contracting company they always work with probably requires it. Whether or not the policy is actually providing any real protection to anyone (except the ghost) is a conversation for another day. An actual workers comp ghost policy cost can be pretty low.

Many states allow these kinds of policies. Just like above, you find them with quick web searches for things like “workers comp ghost policy Missouri” or “workers comp ghost policy va”.

Even so, holders of ghost policies are often audited, and if the auditor discovers that the policy holder’s eligibility lapsed, the fines can be hefty. That’s why the cheapest workers comp ghost policy may not be the best.

How To Get A Workers’ Comp Certificate

Now let’s go back to pretending you’re that new compliance admin getting through your first month on the job. You just got handed a stack of new contractors the company wants to do business with, but you need to ensure their coverage is acceptable. Here’s how to get a workers’ comp certificate.

It sounds simple, but you just ask for it. A good contractor will have already done their diligence; they will know what your coverage requirements are, and will have either met those requirements or adjusted their coverage with their insurer so they are compliant; these contractors often have the COI handy, and may have already provided it.

Sometimes the contractors aren’t ready. Sometimes they’ll look at you and say “how do I get a copy of my workers’ comp certificate” and you’ll have to tell them to talk to their insurer. Hopefully the hiring organization inside your company will have taken care of this part already, but… hopefully isn’t a good way to stay compliant.

You may find it’s a good idea to keep a sample letter requesting certificate of insurance from subcontractor’s agents. It can save you a lot of time, especially if you’re dealing with a large volume of certificates without the aid of a certificate tracking system.

Workers’ Comp Exemption Sole Proprietorship

We said above, and it’s true, that almost every form of business is legally required to hold workers compensation coverage. We also said there are exceptions for single-employee or sole proprietorships in many states. And even though we said it, and it’s true, it’s still a little confusing. Let’s look again at what the workers’ comp exemption sole proprietorship world looks like.

If you’re a sole proprietor, you can often choose whether or not to carry standard workers comp coverage on yourself, whether to carry a ghost policy, or not carry any coverage. Each of those options has pros and cons. Not carrying coverage is certainly cheaper—unless you get hurt. In that circumstance, carrying workers compensation for yourself, despite the expense, can help defray the cost of your medical bills.

You might find it useful to look at your local workers comp exemption form PDF and see what it says. They’re pretty easy to find with a web search, just put in something like “workers comp exempt form ny” or “workers comp exemption sole proprietorship Florida.” You can usually find what you need in the first couple results.

And don’t forget, especially if you’re a subcontractor who works for a lot of general contractors: sometimes the GC will require you to have coverage, no matter what the law says.

Proof Of Workers’ Compensation Coverage

If you’re a compliance admin, getting proof of workers compensation coverage is a core part of what you do. Usually it’s very simple: contractors will provide their own COIs, and will have done the work to make sure they’re compliant with your rules. You can just check the boxes and the coverages and move on.

But you do have to check. Just having proof of coverage insurance doesn’t mean a contractor is compliant. Sometimes you have to verify or request changes in coverage. Usually you can deal directly with an insured’s insurer to make verifications of coverage amounts, exceptions and limitations.

If you’re just trying to verify whether they’re covered, the internet can be very useful. Basic web searches like these will get you to the state verification sites that list every business or contractor that is maintaining their coverage:

- workers’ compensation coverage verification Texas

- verify workers’ compensation coverage New York

- Georgia workers’ compensation verification

- New Jersey workers compensation verification

- California workers’ compensation verification

Putting any of those into a web search will get you on the right path. And always remember, businesses and contractors are responsible for their own coverage. Don’t be afraid to make them pursue their own compliance before you work with them.